As we step into 2026, the cryptocurrency market is buzzing with speculation about Bitcoin's (BTC) future price. With Bitcoin currently hovering around $90,000, investors are eager for insights into where the leading digital asset might head this year. This Bitcoin price prediction for 2026 explores expert forecasts, key influencing factors, and potential scenarios to help you navigate the volatile crypto landscape. Whether you're a long-term HODLer or a trader eyeing short-term gains, understanding BTC's trajectory could be crucial for your strategy.

Historical Bitcoin Performance Leading into 2026

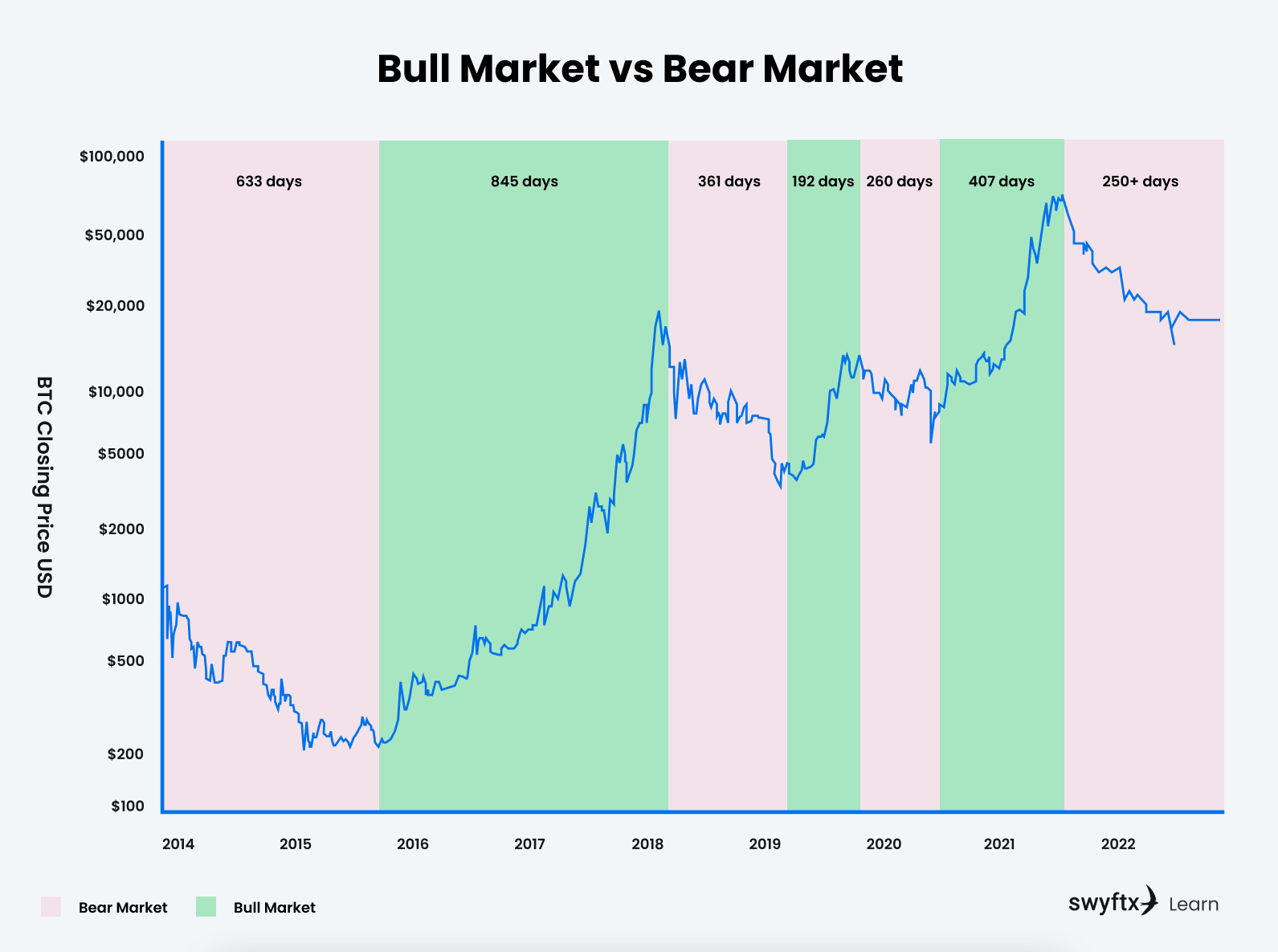

Bitcoin has had a rollercoaster journey, marked by halving cycles, institutional adoption, and macroeconomic shifts. In 2025, BTC experienced a 6% decline overall, despite hitting all-time highs earlier in the year. This came after a turbulent end to the year, with prices swinging amid Federal Reserve policies and market corrections. Historically, post-halving years like 2025 often set the stage for bullish runs, but 2026 could break the traditional four-year cycle, potentially leading to new all-time highs.

Key Factors Influencing Bitcoin Price in 2026

Several elements could drive or hinder BTC's price this year:

- Macroeconomic Environment: Federal Reserve rate cuts and a supportive Trump administration are seen as major catalysts for a rebound. If inflation cools and risk assets normalize, Bitcoin could outperform stocks and gold.

- Institutional Adoption: Pension funds, ETFs, and major financial institutions are increasingly allocating to crypto. The Clarity Act's potential passage could integrate BTC into 401(k)s and portfolios, boosting demand.

- Supply Dynamics: With Bitcoin's fixed supply of 21 million coins and ongoing halvings reducing new issuance, supply shocks could propel prices higher, especially if millionaire demand surges.

- Regulatory and Market Sentiment: Positive regulations could spark a bull run, while any bearish reversals might push prices lower amid volatility.

- Technological Developments: Advancements in Bitcoin's ecosystem, like Ordinals and Runes, along with broader AI and crypto integration, may enhance utility and value.

These factors suggest a mostly bullish outlook, though risks like economic downturns remain.

Expert Bitcoin Price Predictions for 2026

Predictions for Bitcoin in 2026 vary widely, reflecting the asset's inherent volatility. Here's a roundup from analysts, institutions, and market commentators:

Bullish Forecasts

- Standard Chartered and Bernstein predict around $150,000 by year-end, citing steady adoption.

- JPMorgan sees a bottom at $94,000 but forecasts $170,000 in 2026.

- Coinpedia anticipates $150,000 to $230,000, driven by institutional inflows.

- The Bitcoin Rainbow Chart suggests an ultra-bullish $300,000 to $500,000 range.

- Crypto analyst Plan C expects BTC to hit $200,000+ in 2026, never dipping below $70,000.

- Mike Alfred's model points to $315,000, emphasizing supply constraints.

Mid-Range and Conservative Estimates

- Changelly forecasts a minimum of $130,516 and a maximum of $153,147, with an average around $134,174.

- Binance predicts $114,856, assuming moderate growth.

- Julius's power law model estimates $71,000 to $349,000, with fair value at $155,000-$211,000.

Bearish Scenarios

- Mike McGlone warns of a drop to $50,000 if risk assets normalize.

- Marino predicts a dip to $60,000 in summer before a new bull market.

- Davis Le foresees a massive crash to $26,000-$37,000.

Overall, mid-range forecasts cluster between $120,000 and $170,000, with upside potential to $250,000+ if catalysts align.

To visualize these projections, here's a chart summarizing analyst forecasts for BTC in 2026:

Another perspective on potential price trajectories:

Bullish vs. Bearish Outlook for BTC in 2026

The consensus leans bullish, with many experts like those at K33 Research expecting Bitcoin to outperform traditional assets due to favorable policies and adoption. However, bearish views highlight risks like Federal Reserve tightening or broader market corrections. Market odds from platforms like Kalshi show a 42% chance of BTC exceeding $130,000 this year.

Conclusion: Preparing for Bitcoin's 2026 Journey

While predictions range from pessimistic lows of $50,000 to optimistic highs above $300,000, the average Bitcoin price forecast for 2026 points to significant growth potential, possibly reaching $150,000-$200,000 if institutional momentum continues. Remember, crypto markets are unpredictable—always DYOR and consider risk management. Stay tuned for updates as 2026 unfolds, and keep an eye on key indicators like ETF inflows and regulatory news.

What are your Bitcoin price predictions for 2026? Share in the comments below!

Disclaimer: This is not financial advice. Cryptocurrency investments involve high risk.